The raw food business is thriving, particularly in the pet industry, with a market projected to grow from USD 7.39 billion in 2023 to USD 14.55 billion by 2030. You'll find a gross profit margin of about 31.99%, markedly higher than many other food sectors. Rising pet ownership and a focus on health-conscious choices are driving this trend. While challenges like compliance costs and sourcing complexities exist, the market offers exciting opportunities, especially with e-commerce growth. As you explore further, you'll uncover more about the strategies and innovations fueling this profitable sector.

Key Takeaways

- The raw dog food market has a projected growth rate of 10.16%, indicating strong profitability potential for businesses entering this sector.

- Gross profit margins in the raw food market are reported at 31.99%, significantly higher than average margins in the food and beverage industry.

- The net profit margin in food processing has increased to 12.1%, reflecting improving profitability in the raw food business over recent years.

- Emerging consumer preferences for premium, organic options are driving demand, allowing for higher pricing and better profit margins.

- E-commerce growth presents additional revenue opportunities, enhancing market reach and accessibility for raw food products.

Market Overview and Projections

As of 2023, the global Raw Dog Food market stands at approximately USD 7,387.57 million, and it's projected to nearly double, reaching around USD 14,546.03 million by 2030. This significant growth reflects a compound annual growth rate (CAGR) of 10.16% from 2024 to 2030.

North America dominates the Raw Food Market, holding a substantial 43.36% share, driven by high disposable income and pet ownership rates. The increasing awareness of pet health, similar to the focus on nutritional benefits for humans, has led to a rising consumer preference for natural pet products, which emphasize health benefits for pets.

This shift is evident in the diverse product types available, such as dry food, which commands a 62.13% market share, and wet food, making up 37.89%. As pet owners become more conscious of their pets' nutrition, the demand for raw feeding practices continues to grow.

Projections suggest that this upward trajectory will persist, driven by an expanding awareness of pet health and wellness. By understanding these dynamics, you can better navigate the Raw Food Market landscape and capitalize on the opportunities it presents, ensuring your business remains competitive and profitable in this thriving sector.

Growth Drivers and Trends

As you explore the raw food market, you'll notice that increasing pet ownership rates are driving demand for premium products.

Additionally, the growing awareness of pet health and nutrition is leading owners to evaluate options like ultimate hamster care for their pets.

Health consciousness among pet owners is also on the rise, pushing them to seek out nutritious options for their furry friends.

Together, these trends create a robust environment for growth in the raw food sector.

Increasing Pet Ownership Rates

Pet ownership rates in the U.S. are on the rise, with around 66% of households welcoming furry companions into their lives. This trend markedly boosts the demand for pet food, particularly in the Raw Dog Food sector.

As you explore the pet food market, you'll notice how pet owners increasingly prioritize health and nutrition for their pets. This shift aligns with broader trends in consumer spending, as pet owners are more likely to invest in premium nutrition options that support their pets' well-being.

- Fresh, nutrient-dense ingredients

- Tailored diets that mimic natural feeding habits

- A shift towards holistic pet care

The overall pet industry hit $261 billion in 2022, showcasing the rising consumer willingness to invest in premium pet nutrition. North America leads this growth, supported by a strong focus on pet humanization, where owners view their pets as family members deserving the best quality.

Meanwhile, the Asia-Pacific region is quickly catching up, as pet ownership rates continue to soar.

With the global Raw Dog Food market projected for notable growth, this trend reflects a broader shift towards natural, high-quality diets. As more pet owners adopt raw feeding practices, the opportunities for businesses in premium pet nutrition will flourish, catering to changing consumer preferences.

Health Consciousness Among Owners

A growing awareness of health and nutrition is driving pet owners to make informed choices about their pets' diets. With a 66% pet ownership rate in U.S. households, you're likely part of a demographic that increasingly prioritizes healthier, natural diets for your furry friends.

This rising health consciousness has sparked a significant shift towards raw dog food and organic pet food options. Approximately 60% of you prefer raw diets, reflecting a demand for nutrient-dense, preservative-free food that aligns with personal wellness trends.

Additionally, similar to the focus on effective strategies for weight loss, pet owners are increasingly considering the nutritional value and health benefits of the food they provide, emphasizing the importance of balanced diets for overall wellness.

As pet parents, you're becoming more concerned about what goes into your pets' bowls, leading to a notable consumer focus on nutrition and overall wellness.

The global raw pet food market is projected to grow at a CAGR of 10.16% from 2024 to 2030, indicating a robust market growth fueled by your desire for better pet nutrition.

Health-focused formulations, including allergen-free and specialized diets, are emerging as crucial offerings in the market. This evolving trend showcases your commitment to providing the best for your pets, ensuring they thrive on diets that support their health and well-being.

Shift to Premium Products

The growing health consciousness among pet owners is driving a notable shift towards premium raw food products. As you explore the raw dog food market, you'll notice a strong trend toward premiumization. More consumers are making health-conscious choices for their pets, seeking out options that boast natural ingredients and innovative product formulations.

This shift isn't just a fad; it's a reflection of pet humanization, where owners treat their pets like family members. Additionally, the emphasis on transparency and quality is leading many consumers to investigate the risks and rewards of investments in premium pet food brands, ensuring they're making informed purchasing decisions.

Consider these enticing premium offerings:

- Freeze-dried raw dog food packed with nutrients

- Organic ingredients sourced from trusted farms

- Tailored recipes designed for specific health needs

As of 2023, revenue from premium raw dog food products is expected to make a significant impact on market profitability, highlighting the growing consumer preference for high-quality pet nutrition.

The global pet food market, valued at $261 billion in 2022, underscores the robust willingness among consumers to invest in premium products. With health-focused marketing strategies and unique formulas, premium raw food offerings are solidifying their position as a lucrative segment, making it an opportune time to immerse yourself in this thriving market.

Product Types and Segmentation

In the raw dog food market, understanding the breakdown of product types can help you identify key consumer preferences and trends.

Innovations in formulations, such as those seen in the best herbal tea for period pain, markedly impact purchasing behavior, driving demand for products like freeze-dried and dehydrated options.

Market Share Breakdown

With a diverse range of product types, the raw food market showcases distinct segments that reflect consumer preferences. In 2021, chicken dominated the market share, followed closely by beef and lamb, highlighting the specific protein sources pet owners favor. The frozen raw pet food segment currently leads the industry, driven by the demand for fresh and nutritious options.

Additionally, the incorporation of nutrient-rich ingredients like chia seeds is becoming increasingly popular among consumers seeking health benefits.

- Freeze-dried raw food offers convenience and an extended shelf life.

- Organic diets are increasingly popular among health-conscious consumers.

- Innovative product formulations are reshaping purchasing behaviors.

Revenue data from 2017 to 2023 indicates a continuous growth trend within the raw food segment, fueled by a notable shift toward organic and raw diets.

The projected growth for the market by product type from 2023 to 2031 suggests a sustained increase in demand for both raw and freeze-dried options. This trend emphasizes the importance of innovative product formulations in capturing market share.

Understanding these market segments is essential for businesses looking to thrive in the competitive landscape of the raw food market. By aligning with consumer preferences, companies can strategically position themselves for success.

Consumer Preferences Trends

Consumer preferences in the raw food market are rapidly evolving, reflecting a growing demand for healthier and more convenient options. You might notice that many pet owners are leaning towards organic options, particularly in dog food applications. Freeze-dried dog food is gaining traction due to its perceived health benefits and ease of use.

Here's a quick breakdown of current trends:

| Product Type | Market Share |

|---|---|

| Dry Food | 62.13% |

| Wet Food | 37.89% |

| Specialty Diets | Increasing Demand |

The market segmentation reveals that dry food is favored for its longer shelf life, making it a practical choice. Additionally, there's a notable rise in demand for specialty diets tailored to pets with health issues. With online shopping trends on the rise, pet owners prefer the convenience of purchasing raw food products from the comfort of their homes. This shift not only highlights changing consumer preferences but also emphasizes the importance of adapting to the evolving raw food market landscape.

Product Innovation Impact

Product innovation markedly shapes the raw food market, driving both product types and segmentation. As consumer preferences evolve, you'll notice a significant shift toward nutrient-dense ingredients and health-focused formulations.

For instance, many consumers are increasingly interested in holistic health approaches, including the use of essential oils for wellness that can complement their dietary choices. The market is rich with diverse offerings, catering to different needs and tastes.

- Chicken, Lamb, and Beef: These proteins dominate, with Chicken leading in market share.

- Freeze-Dried and Dehydrated Options: These innovations provide convenient, long-lasting choices.

- Wet vs. Dry Raw Food: Dry raw food captures about 62.13% of the market share, while wet raw food appeals for its hydration and taste.

This dynamic landscape reflects how product innovation influences purchasing behavior. As you explore raw food segments, you'll find that unique flavor profiles and organic ingredients draw consumers toward these options.

The rise of freeze-dried and raw formulations showcases a growing interest in high-quality, nutritious choices. With the raw food market projected to continue its growth, staying attuned to these trends will help you understand how product types and segmentation impact profitability.

Embracing these shifts will be essential for anyone looking to thrive in this competitive space.

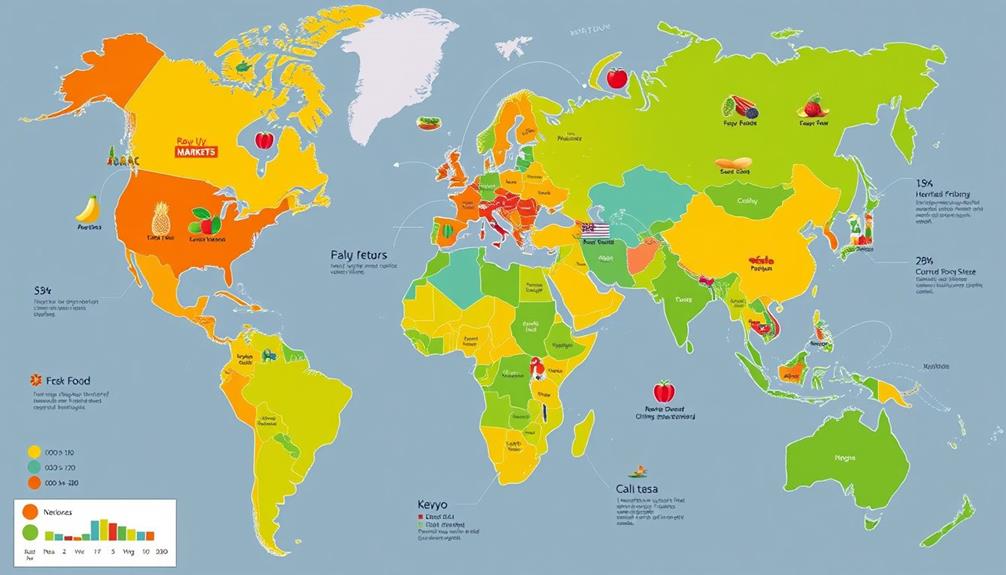

Regional Market Insights

How do regional dynamics shape the raw food market for pets? In North America, you'll find that this region leads the market, boasting a staggering 43.36% share. High disposable incomes and a strong culture of pet ownership fuel the demand for premium pet food. Additionally, pet owners are increasingly becoming aware of the benefits of natural remedies alongside conventional pet food options, which further drives the market.

Meanwhile, Europe holds 28.15% of the market, with countries like Germany and the UK showing significant interest in high-quality pet food offerings, as well as a growing trend towards cold medications overview for pets.

The Asia-Pacific region, with an 18.15% market share, is on the rise. Urban pet ownership in countries like China and Japan is increasing, creating exciting growth potential. Emerging markets, particularly in Brazil and India, are also beginning to show promise as pet ownership rises in the Middle East, Africa, and South America.

Cultural attitudes toward pet care play an essential role in shaping these dynamics. North America and Europe exhibit robust market maturity, while developing regions present unique opportunities for growth.

As you explore these regional insights, it's clear that understanding these dynamics is vital for steering through the lucrative raw food market for pets.

Competitive Landscape

As the raw food market for pets continues to evolve in response to regional dynamics, understanding the competitive landscape becomes essential for stakeholders. In 2023, this market was valued at approximately USD 7.39 billion, with major players like The Farmers Dog, Natures Menu, and Open Farm dominating the scene.

These companies collectively hold significant market share, driving trends and shaping consumer preferences. The importance of diversification benefits in investment strategies is paralleled in the raw food market, where companies are diversifying their product offerings to meet varying consumer demands.

Key elements of the competitive landscape include:

- Innovative product formulations that cater to health-focused options

- Mergers and acquisitions that expand market presence

- Ingredient transparency and sustainable options that resonate with ethical consumers

With a projected growth rate of 10.16%, the raw pet food market is on a trajectory to reach nearly USD 14.55 billion by 2030.

As companies navigate this competitive landscape, they're increasingly focusing on sustainability and ingredient quality, aligning their strategies with evolving consumer preferences. By emphasizing health-focused options and ethical sourcing, these major players not only enhance their market reach but also cultivate a loyal customer base committed to high-quality, transparent products.

Understanding these dynamics is vital for anyone looking to enter or thrive in this burgeoning industry.

Challenges and Risks

Navigating through the raw food business for pets isn't without its challenges and risks.

You'll face significant regulatory challenges regarding food safety standards, which can ramp up compliance costs and impact your profitability. Moreover, sourcing raw materials is often complicated by environmental factors and geopolitical events, such as the Russia-Ukraine war, leading to fluctuating production costs that can squeeze your profit margins.

High production costs associated with maintaining quality and sourcing premium ingredients can create tension, especially when you're competing with lower-priced processed food options. Consumer skepticism about raw diets can also hinder your market growth, compelling you to invest in education initiatives and transparency efforts that might divert funds from other profit-generating activities.

Additionally, the shorter shelf life of raw food products due to the absence of preservatives necessitates careful inventory management. You'll need to guarantee rapid sales to prevent spoilage, which directly impacts your overall profitability.

Balancing these challenges while aiming for success in the raw food industry is a delicate act that requires strategic planning and adaptability.

Profitability Analysis

The raw food business for pets shows promising profitability potential, with a gross profit margin of 31.99% reported in early 2024. This impressive figure indicates that your venture can thrive in a market where average profit margins in food and beverage typically range from 5% to 20%.

The net profit margin in food processing also climbed to 12.1%, a significant rise from 5.16% in 2019, showcasing improved efficiency.

To visualize this lucrative opportunity, consider the following:

- Rapidly growing demand for raw food options.

- Emerging players consistently innovating in the market.

- Strategic management practices enhancing overall profitability.

With a projected market growth rate of 10.16% CAGR from 2024 to 2030, the raw food business stands at an advantageous position.

However, you must remain aware of high production costs and regulatory challenges that may affect profit margins. Adopting effective strategic management can help mitigate these issues, allowing you to capitalize on the growing demand and guarantee your business maintains a solid net profit margin while maneuvering the complexities of food processing.

Future Outlook and Strategies

Looking ahead, the raw pet food market offers exciting opportunities for growth and innovation. With a projected CAGR of 10.16% from 2024 to 2030, you can capitalize on this market growth by responding to increasing consumer demand for natural, nutrient-dense options.

Focus on product innovation to create tailored diets that meet specific health needs, aligning with the trend of premiumization in pet nutrition.

To expand your reach, enhance your e-commerce presence. As consumer preferences shift towards convenience, leveraging online sales channels can boost accessibility to your raw pet food products.

Furthermore, sustainability and ingredient transparency are essential strategies. Today's consumers prioritize high-quality, ethically sourced ingredients, which can foster brand loyalty and trust in a competitive landscape.

However, be mindful of regulatory challenges. Ensuring compliance with safety standards is vital for maintaining profitability and securing long-term growth in the raw food sector.

Frequently Asked Questions

How Profitable Is the Food Business?

You'll find the food business can be quite profitable, with margins varying widely. Specialty products often yield higher profits, but factors like efficiency and compliance can greatly impact your bottom line. Keep these in mind!

How Much Money Does the Food Industry Generate?

The food industry generates substantial revenue, with the global market hitting around $261 billion in 2022. By focusing on consumer preferences and trends, you can tap into this lucrative sector for potential growth and profit.

Conclusion

To sum up, the raw food business is thriving, with market projections expecting it to reach $15 billion by 2027. This growth reflects a rising consumer demand for healthier, unprocessed options. As you consider entering this market, keep in mind that adaptability and understanding of consumer trends are key to success. With the right strategies, you can tap into this lucrative sector and ride the wave of health-conscious eating.